The CBD.fr team has translated the NEW FRONTIER DATA article into French for your convenience… you will find the original article, written by Oliver Bennett, here. The European cannabis market is less mature than in the United States and Canada. The increasing number of dispensaries and retail outlets emerging in newly legalized territories has become one of the most significant and exciting business trends of the last decade.

What could Europe learn from the other side of the Atlantic? After all, while the American industry has suffered from legal ambiguities stemming from a patchwork of regulations across federal and state laws, Europe has had the opportunity to create a more unified industry, with a growing number of pan-European organizations such as the European Industrial Hemp Association (EIHA), the new European Cannabis Promotion Network (ECAN), and the European Union (EU) itself, which covers 28 of Europe’s 44 countries (the latter including Russia and various microstates).

Nevertheless, the European cannabis landscape also remains quite fragmented. Yet, even with the depredations of COVID-19 disrupting continental and global economies, there is still much to attract investors, including demand from over 740 million people in Europe and three key markets—medical, lifestyle retail, and recreational—that remain chronically unmet, with a third of these markets facing significant illicit demand in the near future. All of these markets carry significant implications: overall, regular European cannabis consumers are projected to spend €62.7 billion (US$68.5 billion) this year (across both regulated and unregulated European markets). The European cannabis market of The US$55 billion market alone serves approximately 42.6 million people (5.9% of the population) across its 28 member states.

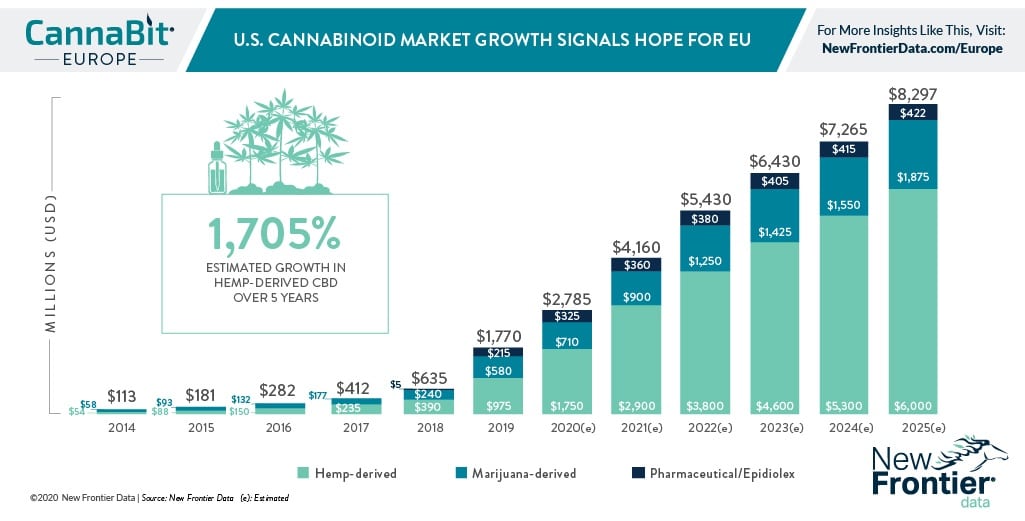

Furthermore, Europe has shown a strong propensity for CBD;

As New Frontier Data shares in the EU CBD Consumers: Overview 2019 report, 46% of Europeans view CBD favorably, and up to 77% of respondents believe CBD should be accessible in some way.

However, obstacles remain regarding cannabis delivery in Europe. The dispensary model used in the US and Canada has not been adopted, so medical cannabis tends to be delivered through pharmacies—as well as through social clubs in countries like Spain and Portugal—and via gray and illicit markets. Recreational cannabis is sold through a limited and compromised group of outlets, including coffeeshops in the Netherlands and a few other decriminalized venues such as Freetown Christiania in Copenhagen, the aforementioned social clubs in Barcelona (and elsewhere in Spain), and, with low CBD content, retail outlets selling cannabis in Italy and elsewhere. While some in the US have looked to the Dutch coffeeshop model as an example of “experience”-style retailing similar to craft breweries (such as splicing cannabis lounges with attached dispensaries), a few cafes in Europe have looked to the North American model for inspiration. A few years ago, the Boerejongens chain in the Netherlands began offering a more upscale environment in which to enjoy a cannabis and seed banking operation, in a setting reminiscent of an Apple Store in its style.In its various forms, CBD in Europe has been widely sold in lifestyle markets, and while most CBD retailers remain online, there is a significant boutique-style market aesthetic (particularly in the wellness and nutraceutical sectors). Even there, complex labeling requirements and a bewildering plethora of brands have led to a rise in curated CBD selectors such as Handpicked CBD, which emphasize and promote brands with certain advantages (i.e., being organic and pesticide-free). Other types of retail experiences have also begun to develop in Europe. Since May, Barcelona—a move spurred by its liberal laws and cannabis clubs—has had a branch of Cookies, the North American lifestyle and cannabis brand, with co-founder and CEO Berner explaining, “We chose Spain as our first overseas store… Barcelona is a place where cannabis consumers from all over the world gather, and we thought it was a must to open a flagship clothing store.” While cannabis-themed, it doesn’t sell the drug in-store; Berner expressed hope for a branded cannabis club in the city, indicating his intention to expand into the leisure sector. There are also delivery innovations in Europe. In Prague, the capital of the Czech Republic, vending machines dispensing cannabis products have recently been installed, selling oils, tinctures, cosmetics, hemp and CBD edibles, as well as a wide range of cold drinks made with cannabis, hemp, and CBD. This decision is based on a market in which half of all Czechs support legalization and shows a willingness to try new ideas. In addition to easing the burden on stores, vending machines also offer anonymity, with compliance factors such as age verification being implemented. While the CBD retail sector is still grappling with the European Novel Food Regulation, it has seen fairly positive developments on the continent, with CBD shops in many major cities and a presence in department stores, multiplexes, and online. In the medical cannabis space, there has been some emulation of the North American market, with investments in companies like Love Hemp offering CBD oils, edibles, cosmetics, and vaporizers in retail stores in the UK (including Holland & Barrett and WH Smith). The journey to achieving contiguity of cannabis markets in Europe has not been easy, but as the pace picks up, retailers on the continent may be on a more solid footing than those in the United States.